This article explores the evolution of technology and its impact on credit card charges, specifically focusing on the increasing challenges of unauthorized charges and credit card laundering.

The Rise of Online Transactions and "Free" Trials

The internet has revolutionized commerce, making it easier than ever to purchase goods and services online. This convenience has also opened up new avenues for fraudulent activities. One common tactic involves offering "free" trial offers that often lead to unauthorized charges.

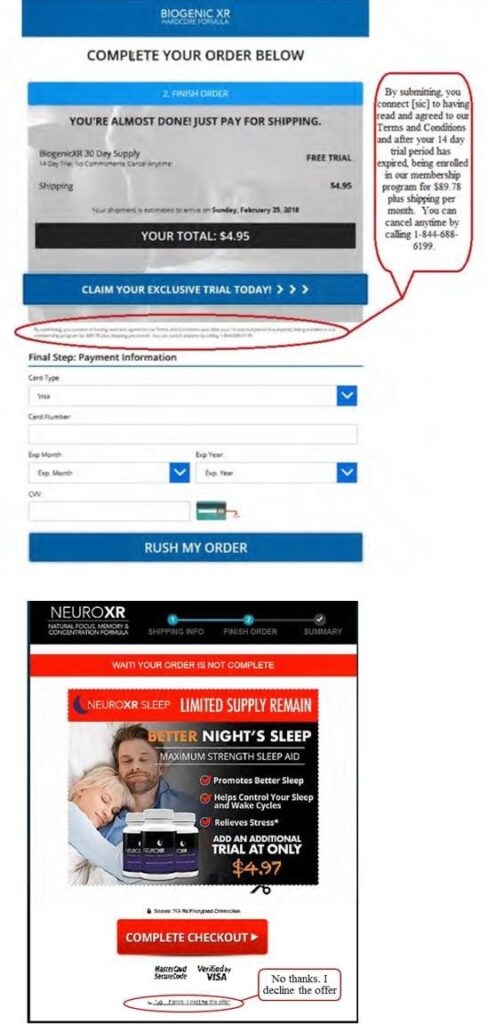

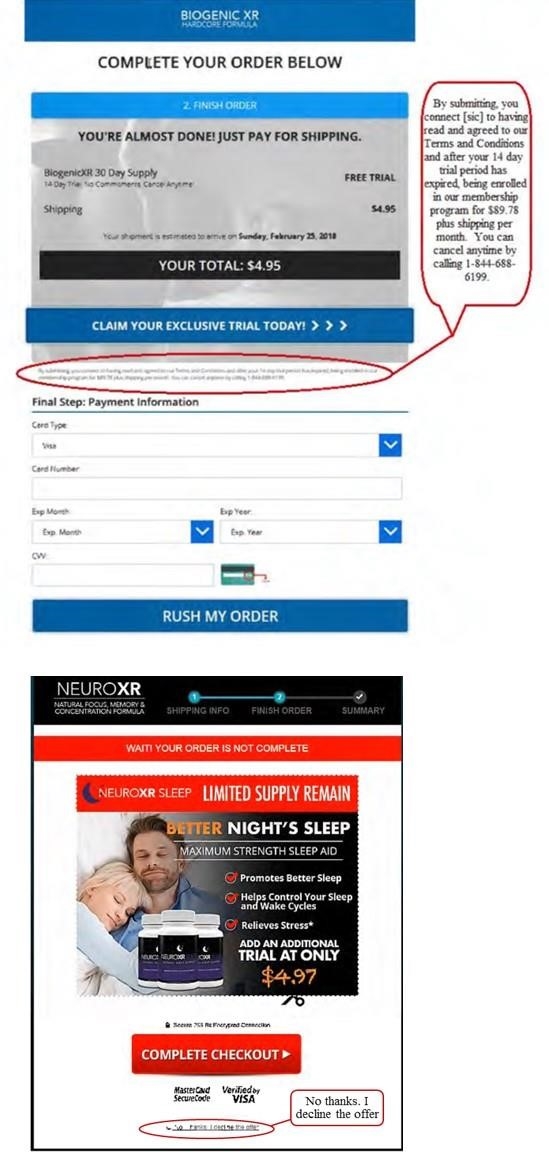

The "Free" Trial Deception

A recent lawsuit filed by the FTC sheds light on a network of corporations and individuals who used deceptive "free" trial offers to lure consumers into recurring subscriptions and unauthorized charges.

These companies employed misleading tactics, such as using "COMPLETE CHECKOUT" buttons that triggered an undisclosed negative option, leading to additional charges without consumer consent. They also made it difficult for consumers to cancel subscriptions or obtain refunds.

The Evolution of Credit Card Laundering

The defendants in the FTC case went further by engaging in credit card laundering. This practice involves using shell companies and straw owners to circumvent credit card associations’ fraud-monitoring programs, making it harder for consumers and law enforcers to detect fraudulent activities.

Hidden Ownership and False Identities

To evade detection, these companies listed straw owners and shell companies in merchant account applications instead of their actual owners. They even provided "commissions" to individuals who were not actually involved in the business, further obscuring the true ownership and operations.

Protecting Yourself from Unauthorized Charges

The FTC case highlights the importance of being vigilant about online transactions and "free" trial offers. Here are some tips to help you protect yourself:

- Read the fine print: Before entering your credit card information, carefully read all terms and conditions, including the cancellation policy.

- Be wary of "free" trials: If an offer seems too good to be true, it probably is. Consider if you really need the product or service before accepting any "free" trial.

- Check your statements regularly: Monitor your credit card statements for any suspicious charges and report them immediately to your bank.

- Use a credit card monitor: These tools can help you detect unauthorized charges and alert you to any unusual activity.

- Be cautious about providing personal information: Avoid sharing your credit card details on websites that look suspicious or lack secure connections.

The Importance of Consumer Protection

The FTC lawsuit is a reminder that technology can be used for both good and bad purposes. It’s crucial for businesses to be transparent in their practices and to prioritize consumer protection.

The Role of the FTC

The FTC is actively working to combat fraudulent practices online, including deceptive "free" trials and credit card laundering. The agency is committed to protecting consumers from these scams and holding those who engage in them accountable.

Conclusion

Learn more about us at: javanet247

As technology evolves, it’s more important than ever to be aware of the potential risks associated with online transactions. By staying informed and taking precautions, you can help protect yourself from unauthorized charges and credit card fraud.